Industry:Banking and Financial Services

Region:Asia Pacific & Japan

Client:Quess Corp

Quess Corp Automates Key Processes to Support Its Hyperscale Staffing Business

20

processes automated in Q2 2019

10 days

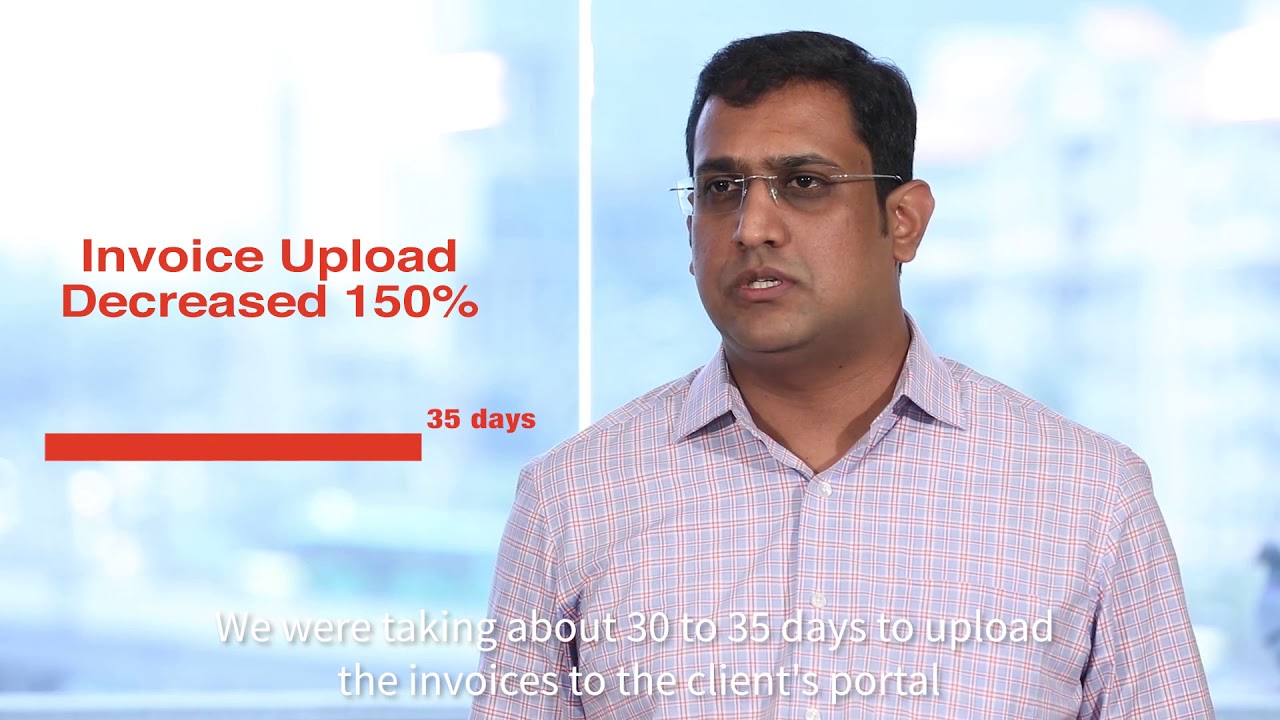

required for RPA-based invoice processing, down from 35-43 days

95-97%

success rate for processes deployed so far

Client Overview

Quess Corp, a Bangalore-based company is India's largest business services provider.

Quess Corp personnel were spending too much time on clerical tasks involved in managing a quickly growing and highly transient workforce. By deploying robotic process automation (RPA), Quess Corp significantly improved its pre-payroll, invoicing, and statutory compliance efficiency without hiring new personnel to manage bulky administrative workflows.

Human resources and finance workflows are essential for every organization, but especially at Quess Corp. The Bangalore-based company is India's largest business services provider. It employs 300,000 people and is rapidly expanding its global footprint to support its influx of clients.

Using the UiPath Enterprise RPA platform, Quess Corp automated part of its repetitive pre-payroll, invoicing, and compliance processes for specific clients without changing its headcount. This alleviated much of the pressure on its employees and optimized core processes. It also helped Quess Corp sustain its growth with fewer resources and without compromising the customer experience.

Sustaining growth and scale: doing more with less

Quess Corp hires between 15,000 and 20,000 new employees every month. This ongoing hiring spree is necessary to maintain the company's multiple business verticals. These include industrial, facility management, people services, technology solutions, and internet business services. More clients mean more work, and more work implies the need for more people.

“The volumes are huge,” Nithin KS, RPA Champion at Quess Corp, said. “We have to deploy manpower internally to address the requirements of various supporting activities that we do for our clients.”

However, the process of onboarding more people is a Herculean task on its own, especially with attrition rates in the 30-40% range. It was becoming increasingly difficult to scale their organization without significantly increasing the headcount to manage the growth.

Close to about 15,000 to 20,000 people get hired every month in Quess, and accordingly, there will be a lot of attrition. There are a lot of statutory requirements that we have to meet when we hire a person.

Nithin KS • RPA Champion

The company particularly struggled with pre-payroll, invoicing, and statutory compliance for their internal hiring efforts and their client-facing staffing services. Invoice submissions were taking well over a month on average. Pre-payroll processes required days of manual work. Likewise, compliance chores were a colossal time and resource drain. Personnel was working "night and day," to support the amassing workloads, according to Nithin. Quess Corp needed a more sustainable solution, one that could cost-effectively sustain the pace of growth.

The RPA way—Ready to payroll. Ready to invoice. Ready to comply.

KS found a more sustainable growth solution in the form of RPA. He saw it as a way to boost productivity and help scale Quess Corp without adding or removing new personnel. After looking into various RPA platforms, he and his team chose UiPath.

“The ease of use of UiPath was one of the major draws,” Nithin said. “And the support we got, I mean, be it a community or the support activities in case of any issues, made UiPath stand out among the group, and it's a pioneer in the space."

The initial few processes Quess Corp automated were completed with the help of a partner called Exponential Digital Solutions. However, Nithin also championed an internal center of excellence to promote RPA self-sufficiency.

The ease of use of UiPath was one of the major draws. And the support we got, I mean, be it a community or the support activities in case of any issues, made UiPath stand out among the group, and it's a pioneer in the space.

Nithin KS • RPA Champion

In total, Nithin and his team of about eight developers automated 20 processes for select clients in the following areas:

Pre-payroll

Automatically collate and upload monthly inputs for payroll processing to a proprietary payroll platform. These include monthly attendance, one-time inputs, salary changes, position changes, and more

Apply client-specific logic to maintain the present days, leave time, etc.; update the leave tracker, and arrive at payables for the month

Manage the master information and updating it to the actual rate and compare it with the minimum wage for the designation and location

Invoicing:

Download timesheets from the client’s portals

Upload the data to the payroll processing system

Calculate the invoice based on the rate card and timesheet

Upload the data to the ERP to generate the invoice

Upload the invoices back to the client’s portal

Statutory compliance:

Prepare input files to be shared with regulatory bodies

Upload employee-specific data belonging to 15,000 staff members into the portal

Download the information

Map the data back to the payroll application

RPA delivers enhanced business outcomes at Quess Corp

Thanks to RPA, Nithin, and his team significantly improved growth management and process efficiency.

Pre-payroll

Collation for master payroll data that initially took up to six days to complete manually is now being done in as little as one hour.

Invoicing:

The number of days for invoice submissions was reduced by 32 days, thereby improving the net time to collections. RPA also helped achieve 100% invoice accuracy with zero rejections.

Statutory compliance:

The number of resources involved in tracking and maintaining legal compliance standards was dramatically reduced.

For the processes that we have deployed so far, we’ve realized a success rate of about 90 to 95%.

Nithin KS • RPA Champion

These benefits were realized without needing to add or remove additional personnel. So far, Nithin and his team have been pleased with the outcome.

“For the processes that we have deployed so far, we’ve realized a success rate of about 95 to 97%.” Nithin said.

Quess Corp plans to extend its automation efforts

Within the next quarter, Quess Corp plans to automate another 57 processes.

There’s no end in sight for the company’s growth. As expansion continues, Quess Corp will rely on RPA to help scale operations without over-burdening existing personnel or hiring more staff to handle multiplying clerical tasks. This will allow the company’s personnel to focus more on customer experience and quality standards, and less on managing growth.

Related case studies

Ready for your own case study?

Speak to our team of knowledgeable experts and learn how you can benefit from agentic automation.